Panama City Beach Condo Market Overview - May 2025

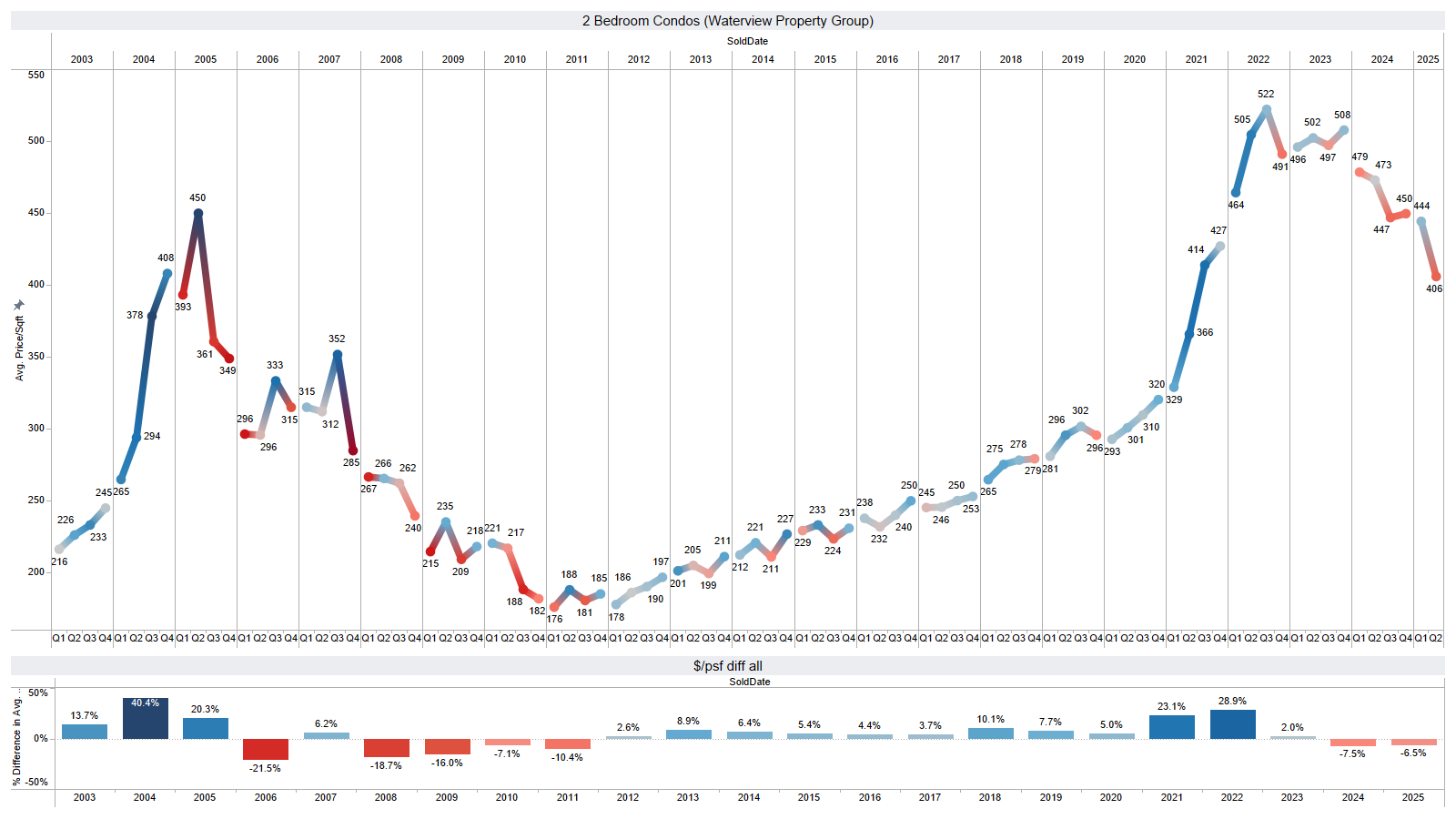

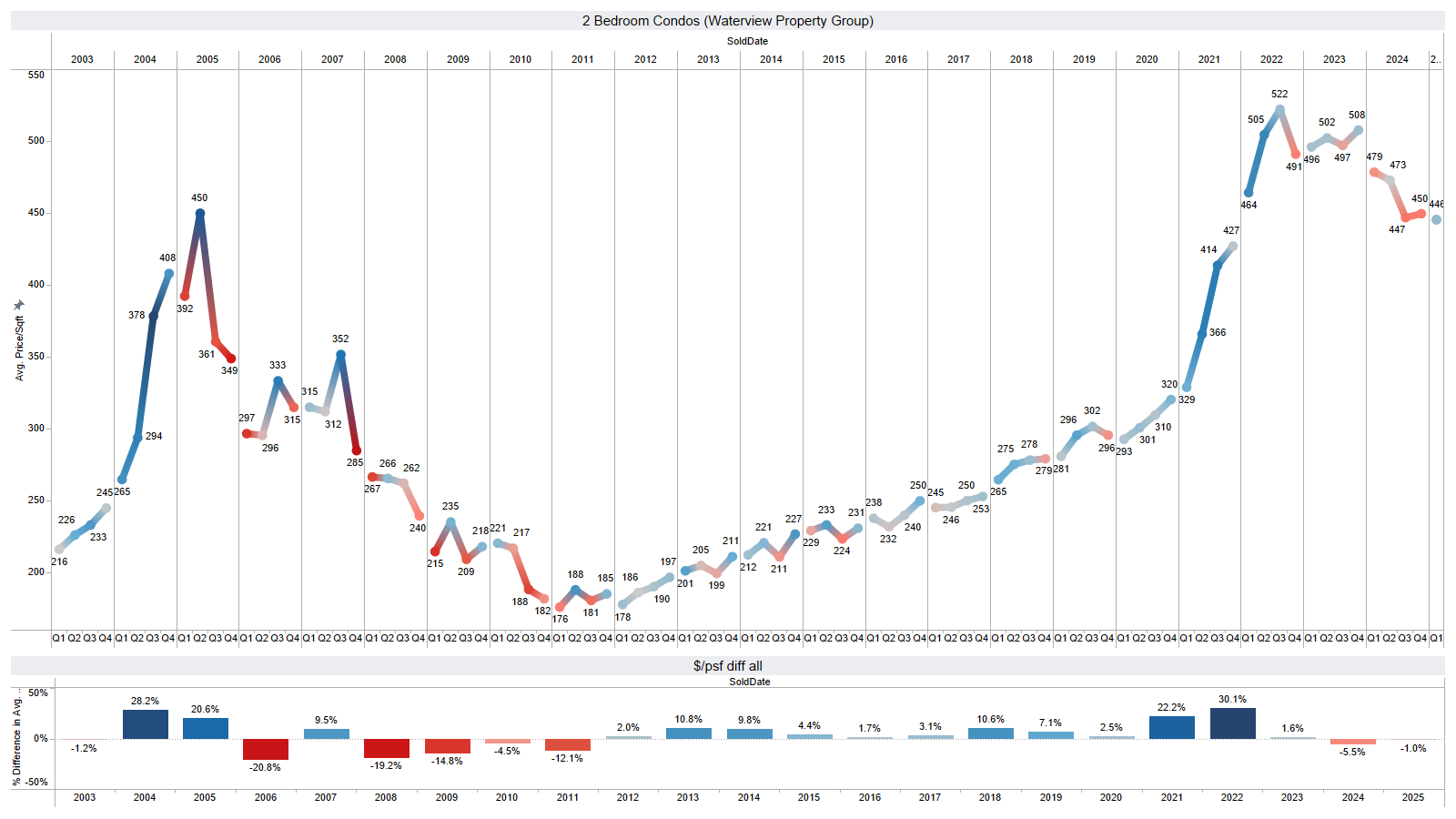

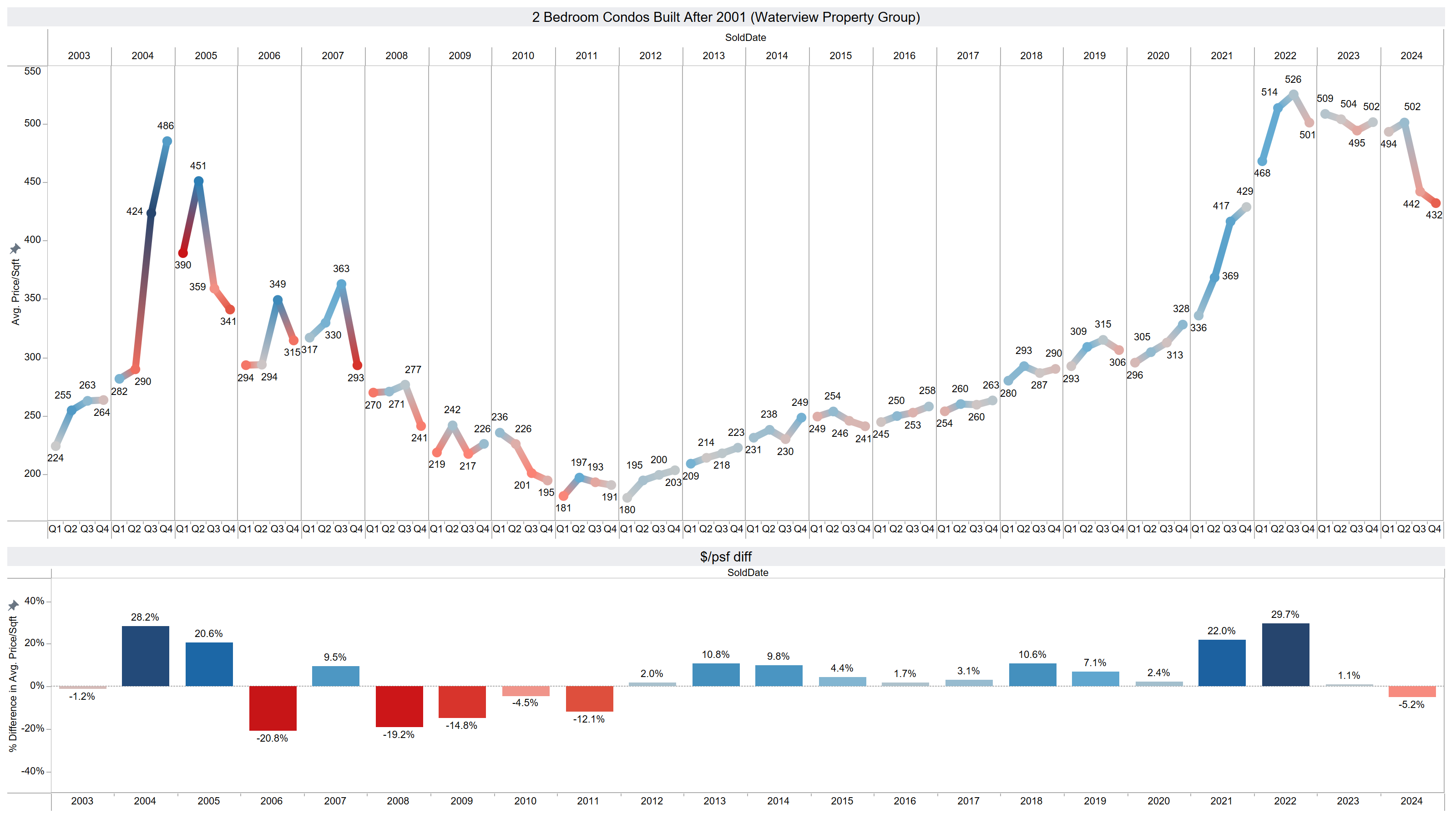

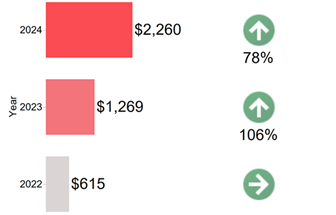

Condo sales volume this year remains sluggish, trailing 29% below 2024’s 20-year record low. Average condo prices have declined by 6.5% compared to 2024’s annual average, with an even steeper drop of 16% when measured against Q1 2024. A deeper analysis reveals a significant split. Condos built before and after 1990 show a much wider price gap.

Calypso Condominium, Real Estate Market Updates, Panama City Beach condos for sale, Panama City Beach real estate

- Created on .

- Last updated on .

- Hits: 4246