Condominium loans in Panama City Beach

As times change, so do condominium loans in Panama City Beach. The reason is because most buyers are people who purchase these properties as secondary residences or investment properties. The type of loans that banks grant for secondary residences are different from those offered for primary residences especially after the mortgage meltdown of 2008. Before the mortgage crisis, most lenders sold their condominium loans to Fannie Mae, Freddie Mac and any other bank or financial institution that was willing to take them on the secondary market.

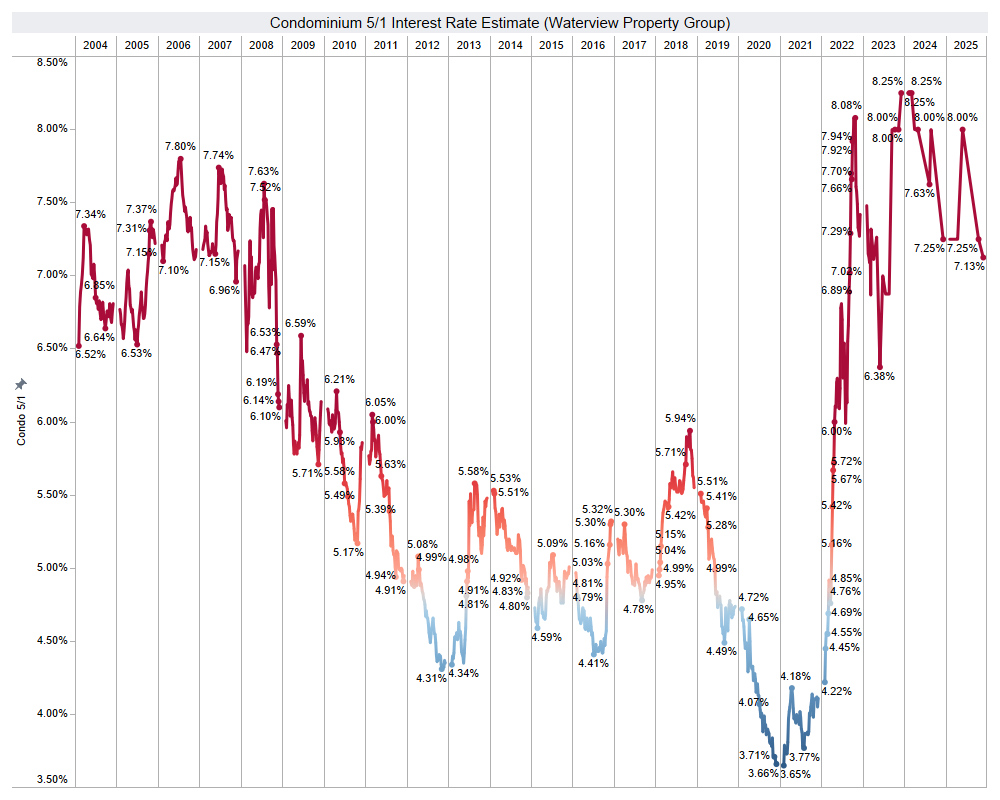

October 2025 Interest Rate Update

Panama City Beach Florida condominium loan / mortgage interest rate update for October 2025.

— Christopher Arnold (@panamabeachreal) October 29, 2025

Interest rates decreased in August 2025 from 8% to 7.25%, and further declined to 7.125% in September 2025.

Purchase Price of 806k or below with 20% down.

5-Year-ARM: interest rate… pic.twitter.com/BAfPdzTBf3

Panama City Beach condo loans currently available as of October 2025

Purchase Price of 806k or below

Lending restrictions, already stringent in 2021, have further tightened since. For those looking to purchase condos in Panama City Beach, the available loan options have become more limited. Particularly for condos priced at $806k or below, the majority of gulf front properties qualify for a range of adjustable-rate mortgage (ARM) options. However, all of these options now necessitate a minimum down payment of 20%.

- 5-Year-ARM

- 7-Year-ARM

- 10-Year-ARM

Purchase Price of 806k or above

For condos with a purchase price above $806k, the financial requirements include a minimum down payment of 25%. The loan options for this price range offer more favorable interest rates.

- 5-Year-ARM:

- 7-Year-ARM:

- 10-Year-ARM

- 15-Year-Fixed: Discontinued June 2024

- 30-Year-Fixed: Discontinued June 2024

This illustrates that while the initial down payment is higher for more expensive condos, at this price point the interest rates are comparatively lower.

Limited Secondary Market for Gulf-Front Condo Loans

Most banks pre-approve buyers for Gulf-front condominium loans but withdraw days before closing due to the near-nonexistent secondary market for these mortgages.

Notable Exceptions

- One bank provides a reliable DSCR (Debt Service Coverage Ratio) portfolio loan program that consistently closes on Gulf-front condos in Panama City Beach.

- Cross Country Mortgage successfully operated a DSCR program starting in Q1 2024.

- Bank Plus briefly relaunched its DSCR program in September 2025 but discontinued it within weeks. They have maintained in-house portfolio loans available since the 2008 financial crisis.

Broader Context

Condo lending standards are extremely strict. The secondary market collapsed after Freddie Mac stopped purchasing condo loans from originators—reverting to conditions seen during the post-2008 crisis (2007–2019), when no viable secondary market existed for these loans.

Panama City Beach Condos restricted from several lenders

What is the Secondary Market?

After you receive a loan from a bank, that bank, generally, does not keep the loan. Instead, it may be sold to Fannie Mae, Freddie Mac, hedge funds, large banking institutions or real estate investment trusts known as REITs. Entities that purchase condominium loans in this manner are known as the secondary market.

Lenders, banks, and mortgage brokers - provide loans to buyers

Fannie Mae, Freddie Mac, Large Banking institutions, and REITs - create loan programs and buy the loan you receive from your lender on the secondary mortgage market.

Loans after the Mortgage Crisis

After the mortgage meltdown, Fannie Mae and Freddie Mac stopped purchasing condominium loans for secondary residences unless the properties can meet very strict guidelines. Since most of the properties in Panama City Beach are secondary residences that owners rent out to others, these properties cannot meet Fannie Mae and Freddie Macs guidelines. This along with the lack of other entities purchasing these types of loans virtually eliminated the secondary market for condominium loans. Secondary Market loans showed up again in 2019 and dissapeared in 2022.

In the years after 2008, a handful of lenders began to grant loans again. This is because a couple of banking institutions created loan programs to keep these loans on their balance sheet, creating the secondary market for condominium loans. There have consistently been three and five-year arms requiring 25-30% down. Interest rates for these loans fluctuate between 4 percent and 6.5 percent.

The rates constantly fluctuate on these three different loans. (rates for different buyers vary. This article is meant to be used only as a guide of what you can expect.)

Condominium Lenders

Most banks are unable to provide financing for condominium properties in Panama City Beach. Sometimes, these entities say that they can, but the truth often comes out about a week before closing that it will be impossible to grant the loan after all. Even so, there are a few banks that will grant loans for condos. There are advantages to different banks depending on the condominium you are financing and your individual situation.

Bank Plus - Kristen Blossman

Bank Plus purchased FBT Mortgage. Kristen Blossman of FTB Mortgage is an expert in condominium properties on the gulf coast, and she has had the best condominium loan programs for well over a decade. For applicants with excellent credit and a good debt-to-income ratio, FTB Mortgage currently offers several condo loan products.

CrossCountry Mortgage

CrossCountry Mortgage has successfully closed numerous loans for gulf-front condominiums. They currently offer a Debt Service Coverage Ratio (DSCR) loan program.

Lindsey Chapman

Mortgage Broker

ccm.com/lindsey-chapman/

Regions Bank

I need to check with Regions Bank to see if they are still offering loans.

Trustmark Bank

Prime Lending - Brian Robinson

Prime Lending is another bank I need to check with.

Cadence Bank

Past Updates

December 2024 Interest Rate Update

Panama City Beach Florida condominium loan program and mortgage interest rate information.

— Christopher Arnold (@panamabeachreal) December 18, 2024

Interest Rates drop in December from 8% to 7.25%.

Purchase Price of 806k or below

5-Year-ARM: 20% down, interest rate 7.25%.

7-Year-ARM: Interest rate 7.35%.

10-Year-ARM: Interest rate… pic.twitter.com/4GQhjfLRBI

August 2024 Interest Rate Update

Update August 2024:;Qualified buyers can expect to get a 5 year arm amortized over 30 years with a rate close to 8%.

5-Year-ARM: 20% down, interest rate 8%.

7-Year-ARM: Interest rate 8.1%.

10-Year-ARM: Interest rate 8.2%.

15 Year Fixed - Discontinued

30 Year Fixed - Discontinued

Update December 14, 2019:;Qualified buyers can expect to get a 5 year arm amortized over 30 years with a rate close to 4.5%.

5/5 ARM - 5.625%

30 Year Fixed - 4.5%

3/3 ARM - 4.25%

10/5 ARM - 5.5%

15 Year Fixed - 5.25%

Update February 10, 2017: Qualified buyers can expect to get a 5 year arm amortized over 30 years with a rate close to 4.5%.

5/5 ARM - 4.5%

3/3 ARM - 4.25%

10/5 ARM - 5.5%

15 Year Fixed - 5.25%

Update June 11, 2015: A stronger-than-expected May jobs report sent bond yields soaring last week. Mortgage rates followed suit. Loan rates jumped twice last week to 4.5% from 4.25%. Condo loans do not follow in lock step with bond yields like primary home mortgages do. For the past year we have seen the 5-year arm fluctuate between 4% and 4.5%. Today rates are back down to 4.375% and tomorrow we are likely to settle in back at 4.25%. Here are the rates you can expect to see for condos this summer.

- 3/3 ARM (30 year term fixed for 3 years) around 4%

- 5/5 ARM (30 year term fixed for 5 years) around 4.25%

- 15 Year Fixed Rate - around 5%

Panama City Beach condos for sale, Condo Financing

- Created on .

- Last updated on .

- Hits: 1065364